- Who We Are

- What We Do

-

-

- Our Services

Industry Expertise

-

Business Functions

Technology

SaaS

-

-

- Insights

- Working at SELISE

- Contact Us

- EN

- DE

en

- EN

- DE

IPEX aimed to revolutionize the insurance claims handling through automation and AI. The rapid development approach delivered an MVP for market proof and attracted seed financing.

Today IPEX is the market leader in Switzerland known to help Insurers improve efficiency and scalability of claims management with their dedicated technological platform.

In 2021, three entrepreneurs embarked on a mission to disrupt the traditional insurance claims handling process by introducing a model that heavily relies on automation and artificial intelligence. Their vision was to outsource the property damage claims management for insurers, enhancing efficiency and scalability. Early into their venture, they secured a partnership with an insurance company willing to pilot their innovative solution. The founders, who knew SELISE from previous experiences, approached SELISE with the challenge of building a Minimum Viable Product (MVP) in just 4 months of time.

Leveraging SELISE Blocks, their modular software development platform known for its pre-built components that accelerate development, SELISE tackled the project head-on. The platform’s adaptability and robustness were crucial in meeting the stringent deadline and budget constraints, leading to a successful on-time launch of the MVP. This early version not only demonstrated the viability of their concept but also equipped the startup with the necessary tools to attract seed financing.

Following this milestone, Stefan Oswald joined as a CTO, who expanded the platforms capabilities by hiring two additional SELISE Fusion teams, which were complemented by an experienced Swiss AI Technology team. Fusion Teams is SELISEs team offering consisting of a blend of analysts and engineers including but not limited to UX designers and software architects. “It’s crucial for us to have a partner like SELISE, who can support us on our agile journey with technical expertise, enabling us to achieve faster time to market and ensuring scalability when needed, driven by their strong identification with our products.” says Stefan.

This strategic expansion was pivotal in scaling their operations and securing a 4. As we delve into the technical aspects of their solution, we’ll explore how this blend of strategic partnerships, agile development practices, and cutting-edge AI has reshaped the landscape of insurance claims management.

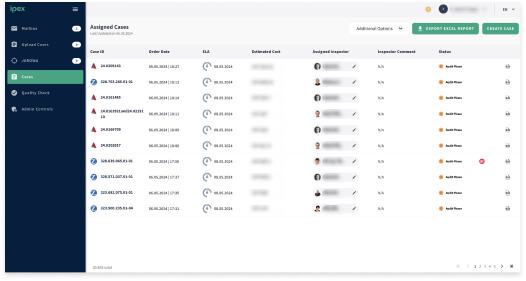

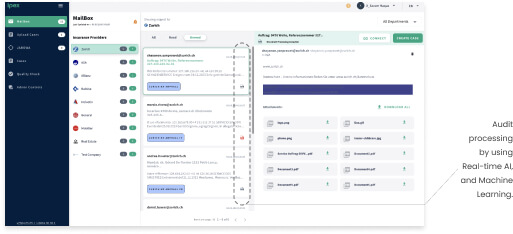

The platform constructed integrates multiple applications tailored to various stakeholders, complete with

At its core, the system addresses the challenge of handling claims, which are essentially bundles of documents that include proposals from construction companies for damage repairs. These documents must be captured via frontend or virtual email inboxes, ingested, and organized efficiently to enable auditors to swiftly generate insightful reports.

As of now, the application has processed over 300,000 claim records and is currently assessing over 2,000 claims monthly. This expansive, anonymized dataset from various Swiss property insurers enriches the platform, enabling it to offer valuable insights into pricing trends within the Swiss property market. This feedback loop ensures that IPEX remains at the forefront of innovation in claims management, continually enhancing its service offerings and providing strategic advantages to insurers and stakeholders alike.

VP of Strategy & Value Proposition

Email: info@selise.ch

Contact Number: +49 89 54196883